UK Property Investment for Expats: Your Guide to a Smart Move

UK Property Investment for Expats: Your Guide to a Smart Move If you’re an expat looking to diversify your portfolio or build a stable asset base, the UK property market often stands out as a top contender. With its robust economy, strong legal framework, and consistent demand, UK property investment for expats presents a fantastic opportunity. But where do you start? This guide will walk you through everything you need to know to make a smart move.

Why Consider UK Property as an Expat?

Investing in the UK can be a savvy decision for several reasons. The market has historically shown resilience and growth, offering both rental income and potential capital appreciation. It’s a stable, transparent market, which provides peace of mind for international investors. Plus, with a vibrant rental sector, especially in major cities, finding tenants is often straightforward.

Benefits Include:

- Stable Market: The UK has a long history of property market stability.

- Rental Yields: Attractive rental income, particularly in high-demand urban areas.

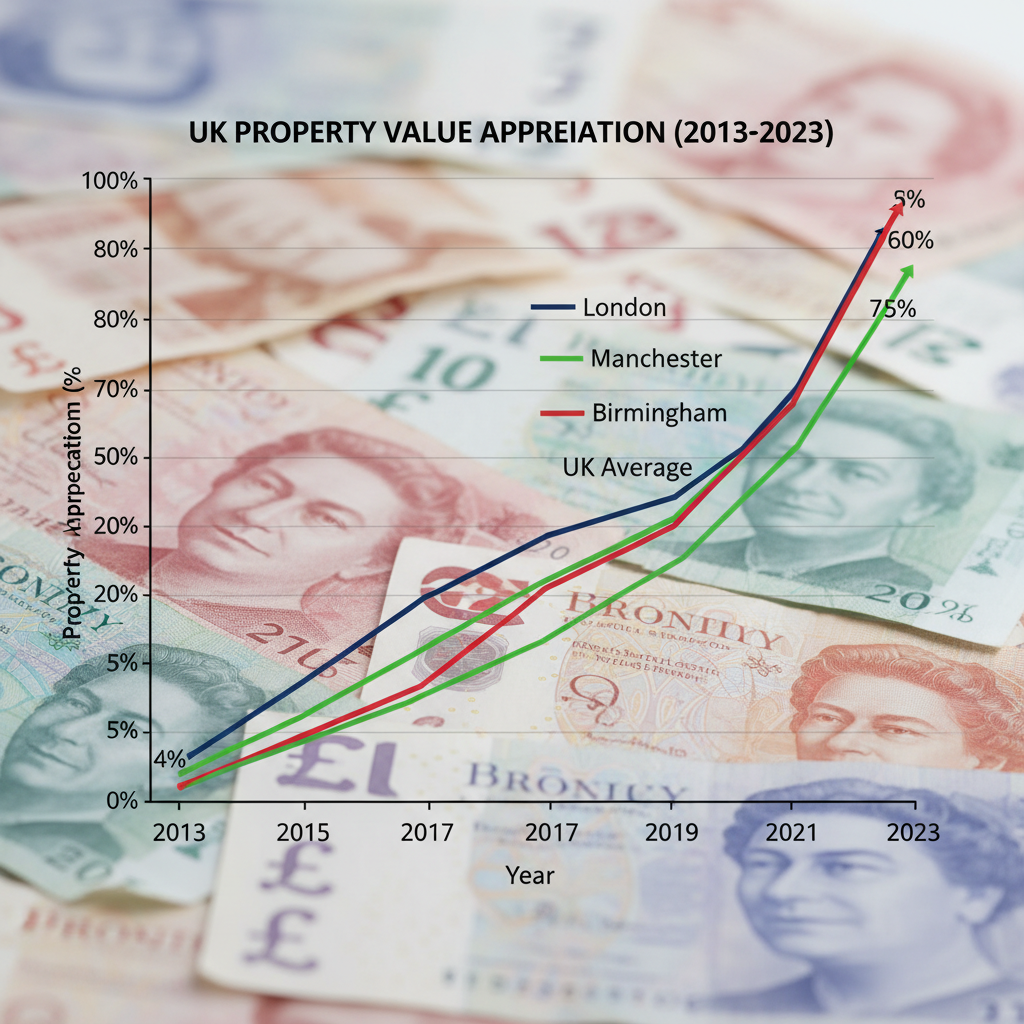

- Capital Appreciation: Potential for your property’s value to increase over time.

- Strong Legal System: A transparent and robust legal framework protects investors.

Key Considerations for Expats Investing in the UK

While the opportunities are vast, expats face unique challenges. Understanding these upfront can save you time and money.

Mortgages for Expats

Getting a mortgage can seem daunting from afar, but it’s entirely possible. Many UK lenders offer expat mortgages specifically designed for non-residents. You’ll typically need a larger deposit (often 25-40%) compared to a resident buyer, and the criteria can vary. It’s wise to work with a specialist expat mortgage broker who understands your specific situation.

Tax Implications

Navigating the UK tax system is crucial. You’ll need to consider:

- Stamp Duty Land Tax (SDLT): Paid when you buy a property. An additional surcharge usually applies to non-residents and those buying a second home.

- Income Tax: If you rent out your property, the rental income is subject to UK income tax.

- Capital Gains Tax (CGT): Paid on the profit when you sell a property that isn’t your main residence.

- Inheritance Tax: Can apply if your UK assets are passed on after your death.

It’s highly recommended to consult with a tax advisor specializing in international property investment to optimize your tax strategy.

Legal and Conveyancing Process

Engaging a reliable solicitor is non-negotiable. They will handle all the legal aspects of the purchase, known as conveyancing, ensuring everything is above board. This includes searches, contracts, and transferring ownership. Choose a firm with experience dealing with international clients.

Property Management

Unless you plan to move back to the UK, you’ll need a property management company. They can handle everything from finding tenants and collecting rent to maintenance and legal compliance, giving you peace of mind from afar.

Popular Areas for Expat Property Investment

Where you invest significantly impacts returns. While London often comes to mind, regional cities offer compelling alternatives.

- London: High entry costs but strong long-term growth potential and consistent demand.

- Manchester: Known for its strong rental market, regeneration projects, and growing economy.

- Birmingham: Great transport links, large student population, and ongoing development make it attractive.

- Leeds: A thriving business hub with a strong employment rate and robust rental demand.

- Liverpool: Affordable entry points and increasing investor interest.

Many expats focus on buy-to-let properties due to the immediate rental income potential.

Your Step-by-Step Guide to Investing

1. Define Your Goals: What are you hoping to achieve? Rental income, capital growth, or a future home?

2. Research: Explore different regions, property types, and market trends.

3. Secure Financing: Speak to an expat mortgage broker early on.

4. Assemble Your Team: Find a trusted solicitor, tax advisor, and potentially a property management company.

5. Find a Property: Use online portals, estate agents, or property sourcing companies.

6. Make an Offer and Complete Legalities: Your solicitor will guide you through this.

7. Manage Your Investment: Hand over to your property manager or manage it yourself if you’re local.

Overcoming Challenges

Distance can be a hurdle, but with the right team, it’s manageable. Regular communication with your solicitor and property manager is key. Also, be aware of currency fluctuations and factor them into your budgeting. Diversifying your investments can also mitigate risks.

Ready to Make Your Move?

UK property investment for expats is a fantastic avenue for wealth creation and portfolio diversification. By understanding the nuances, securing expert advice, and making informed decisions, you can successfully navigate the market and achieve your investment goals. Don’t let distance deter you; the UK property market is open and welcoming to international investors. Start your journey today and unlock the potential of UK property!